In the evolving narrative of Cash Management Services (CMS) in India, dashboards are no longer just operational control panels — they’re strategic command centers. Chapter 2 of the India CMS Handbook 2025 deep-dives into how leading banks structure their CMS dashboards, what key metrics they prioritize, and how those dashboards reflect their maturity in cash management for corporates.

Based on a curated review of real CMS dashboard screenshots from top banks including HDFC Bank, Axis Bank, YES Bank, Kotak Mahindra Bank, IndusInd Bank, and IDFC FIRST Bank, we decode the design philosophy, functional intelligence, and adaptability embedded in these interfaces.

Why CMS Dashboards Matter More Than Ever

CMS clients — whether from NBFCs, eCommerce, PSUs, or FMCGs — now expect real-time visibility into cash flows, faster reconciliations, and smarter alerts. A modern CMS dashboard is expected to offer:

KPI clarity at a glance

Channel-level breakdowns (NEFT, RTGS, IMPS, UPI)

Collections vs Disbursement intelligence

User-defined views, filters, and alerts

Role-specific customization

Comparative Breakdown: Bank-Wise Dashboard Intelligence

HDFC Bank

Visual Tone: Corporate blue with minimalist layout

Key Features: Pie and bar charts for collections/disbursements

Notable Element: Quick KPIs for volume and value

Recommendation: Add sectoral filters and exception highlights

Axis Bank

Style: Data-dense with strong channel focus

Key Features: Payment types split (RTGS/IMPS/NEFT)

Intelligence Level: Operationally robust

Recommendation: Introduce YoY/MoM trend markers with alert symbols

Kotak Mahindra Bank

Design: Compact and modern

Unique Aspects: Collection mapping by product category

Strength: Readiness for industry-specific views

Recommendation: Add predictive alerts and client sector toggles

YES Bank

UI Style: Sidebar navigation, client-centric summaries

Core Utility: Flexible views for custom client dashboards

Potential: Strong modular design foundation

Recommendation: Enable custom threshold breach alerts

IndusInd Bank

Design: Visually rich with dark themes

Analytics Focus: Real-time inflow-outflow metrics

Ideal For: Enterprise clients requiring high-velocity monitoring

Recommendation: Add cash position vs ageing overlays

IDFC FIRST Bank

UI Philosophy: Clean, simplified dashboards

Primary Use: Straightforward KPI review

Strength: Speed, clarity

Recommendation: Enhance with time filters and smart anomaly detection

Framework: The 6-Pillar CMS Dashboard Intelligence Model

To benchmark and build next-gen CMS dashboards, the following framework is useful:

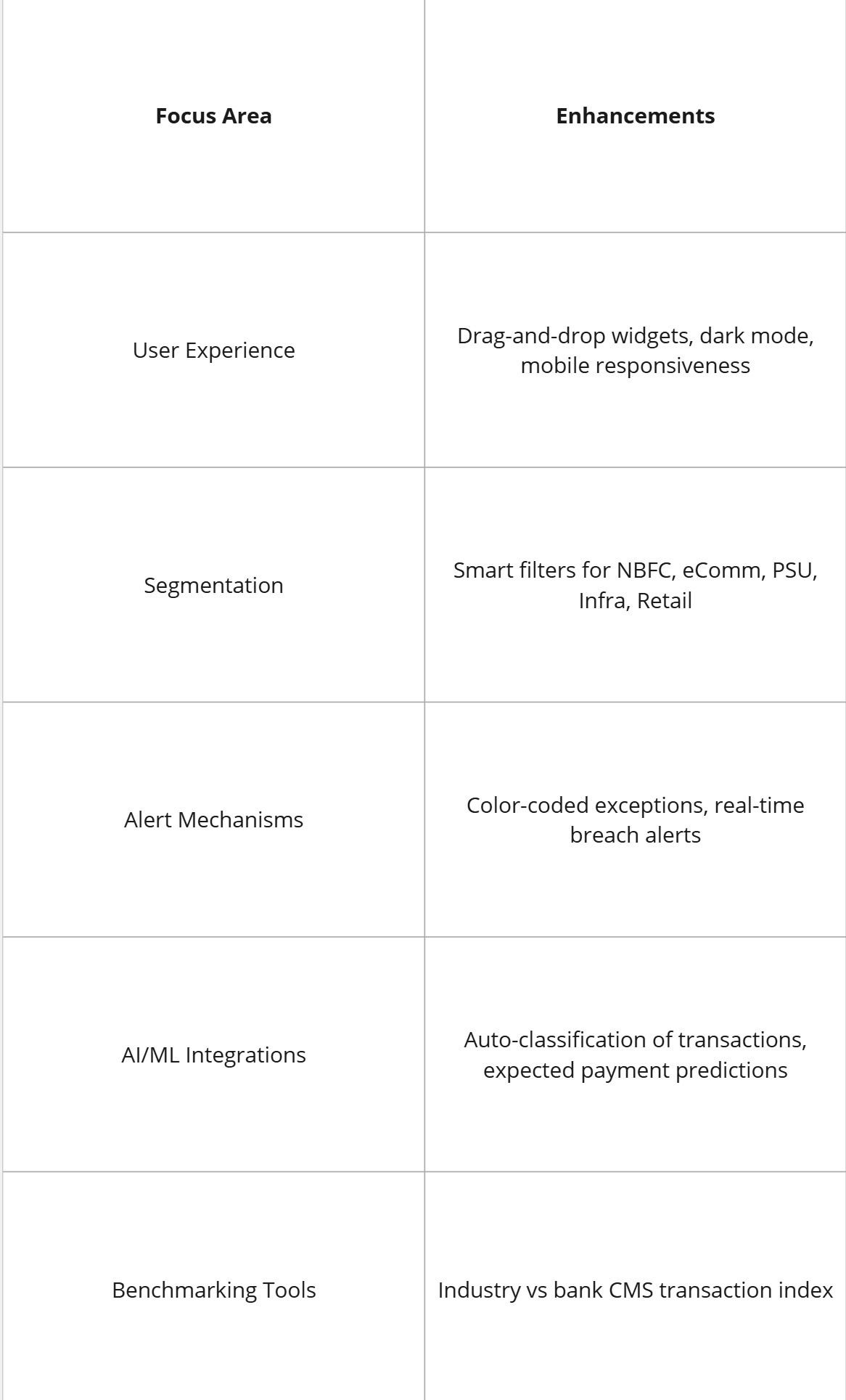

Suggested Enhancements for 2025-ready CMS Dashboards

Closing Thoughts

As India's CMS ecosystem matures, dashboards will become the competitive differentiator for banks. A well-designed CMS dashboard doesn’t just inform — it empowers decision-making, reduces turnaround times, and builds confidence across treasury functions.

In the next chapter, we will dive into bank-wise CMS deep dives, analyzing how each private and public sector bank structures its CMS product stack and delivery mechanisms.

📍Next Up: Chapter 3 – Bank-by-Bank Deep Dive into CMS Capabilities