After exploring dashboard intelligence in Chapter 2, this chapter focuses on granular, bank-wise analysis of CMS capabilities across India's leading private and public sector institutions.

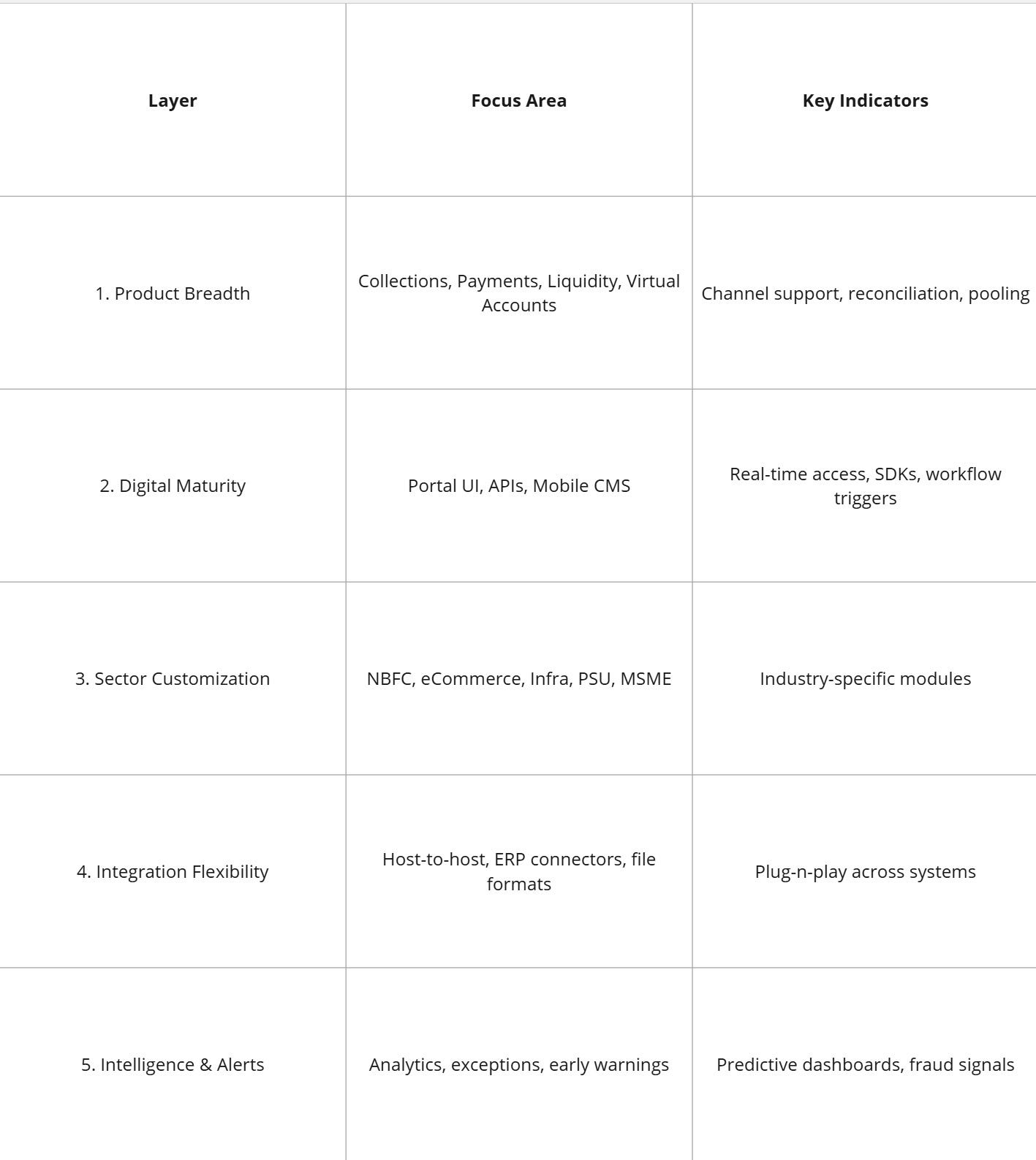

Each bank operates within a unique strategic context, serving different industries, scales of enterprise, and CMS maturity. Here, we evaluate each bank’s CMS proposition using a 5-Layer Evaluation Framework that captures digital readiness, product spread, integration flexibility, analytics depth, and customer experience.

🧩 The 5-Layer CMS Capability Evaluation Framework

🏦 Bank-Wise Deep Dives

🔹 HDFC Bank

Strength: Breadth of CMS products with sector-wide customization

Highlights:

Industry-leading virtual accounts and pooling mechanisms

Real-time dashboards with API integrations

High adoption among NBFCs, corporates, and aggregators

Scope for Growth: Real-time fraud alerts and anomaly detection

🔹 ICICI Bank

Strength: API-first architecture and smart reconciliation engine

Highlights:

Customizable cash pickup/drop schedules

Dynamic UPI and QR collection models

Sector-specific portals for logistics, PSUs, and fintech’s

Scope for Growth: Front-end UX for CMS dashboard lags slightly behind peers

🔹 Axis Bank

Strength: Flexible integration capabilities across CMS modules

Highlights:

Rich host-to-host options and smart liquidity tools

Sectoral CMS packs for Retail, eComm, and Infra

Notable CMS adoption in renewable energy and mid-sized NBFCs

Scope for Growth: Limited innovation in predictive CMS analytics

🔹 YES Bank

Strength: Modular CMS platform architecture

Highlights:

Plug-and-play APIs with instant onboarding

Focus on startups, aggregators, and digital-first businesses

Effective dashboard-level role permissions

Scope for Growth: Requires deeper reconciliation automation

🔹 IndusInd Bank

Strength: Payments and Escrow-focused CMS with real-time adaptability

Highlights:

Exceptionally detailed payment suite

High focus on structured disbursements for NBFCs and supply chains

Scope for Growth: More sectoral dashboards and liquidity tools needed

🔹 IDFC FIRST Bank

Strength: Clean UI, fast adoption cycles for digital-first clients

Highlights:

Agile CMS for SMEs and D2C brands

Smooth file-based processing and basic API sets

Scope for Growth: Lacks advanced pooling or fraud detection modules

🔹 Kotak Mahindra Bank

Strength: Sector-led product structure with stable CMS offerings

Highlights:

Portal-driven CMS built for growth-stage corporates

Moderate analytics tools with clear flows for finance teams

Scope for Growth: Broader file type acceptance and AI-led forecasts

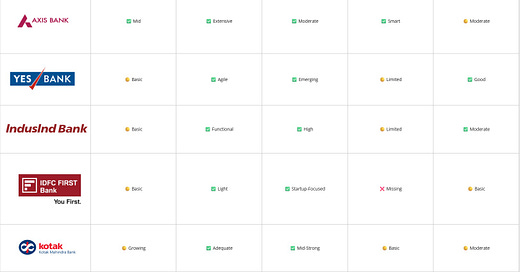

📈 Comparative Snapshot: CMS Feature Maturity Matrix

🛠️ Actionable Insights for Product Teams

NBFC-focused banks (e.g., IndusInd, HDFC) should strengthen early alert systems and predictive pooling to manage large volumes.

Mid-tier banks (e.g., Kotak, IDFC FIRST) can gain edge through sector-focused CMS bundles with low-code onboarding.

Banks with strong APIs (e.g., ICICI, YES) should scale their UI/UX layer to provide parity across channels.

Analytics differentiation is a clear whitespace — no bank today offers truly predictive exception handling in CMS.

🏁 Conclusion: Bank CMS is Becoming a Product, Not Just a Service

The future of CMS is productized. The banks leading the CMS race in India are those who combine modular APIs, dashboard-level personalization, and sector-specific depth. With embedded finance models rising, CMS offerings must become more than utilities — they must evolve into intelligent platforms.