India-Pakistan Conflict Risk: A 10-Dimensional Impact Framework for Financial Institutions

Mapping Market Shocks, Strategic Sectors, and Policy Pathways—A Real-Time War Impact Blueprint for Indian and Global Financial Leaders

As geopolitical tensions rise between India and Pakistan, the specter of conflict between two nuclear-armed nations threatens not only regional security but also global financial equilibrium. For India’s banking and financial ecosystem, it’s not just about watching headlines—it’s about scenario planning, liquidity management, and capital protection.

This playbook provides a banking-centric view of the conflict's ripple effects, equipping stakeholders—from treasury desks to boardrooms—with structured insights and actionable intelligence.

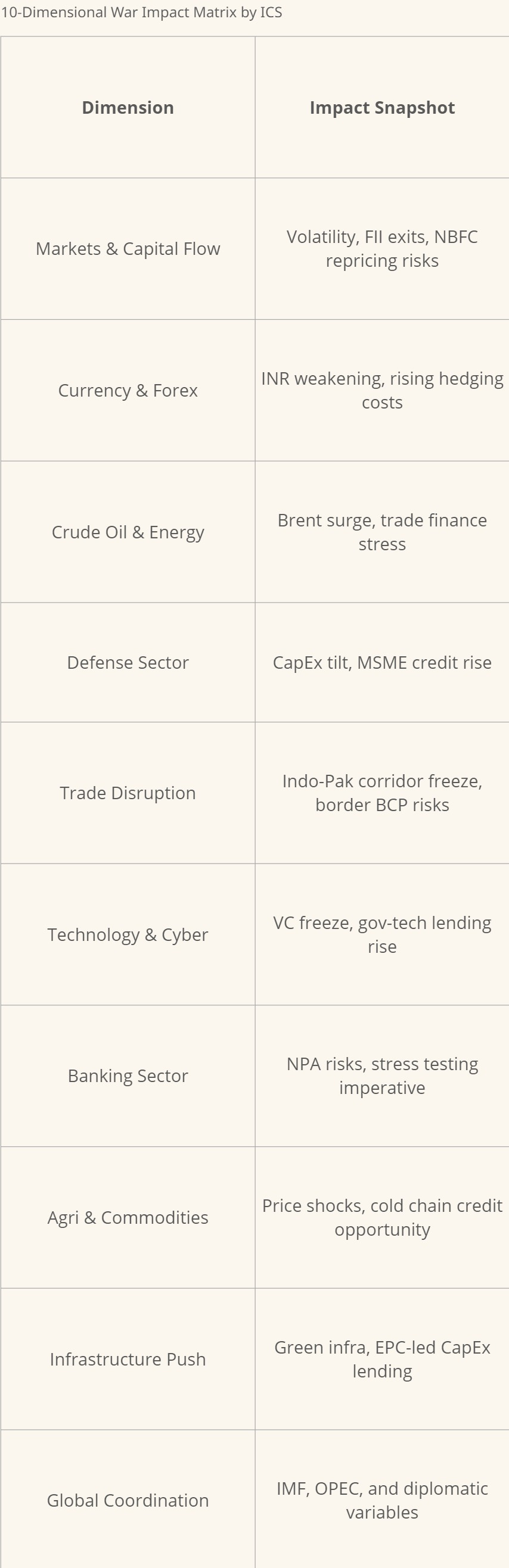

🧭 The 10-Dimensional War Impact Framework

A financial lens on conflict escalation—real-time, risk-weighted, and sector-tuned.

1. Markets & Capital Flow

Expected Impact: Nifty/Sensex dips 3–7% in early reaction windows. Foreign Institutional Investors (FIIs) will likely trigger exits in high-beta stocks.

Banking Lens: Volatility in NBFC debt paper pricing. Liquidity coverage ratios must be stress-tested.

2. Currency & Forex

Expected Impact: INR breaches psychological thresholds (₹85+/USD possible). RBI expected to intervene via USD sell/buy swaps.

Banking Lens: Elevated hedging costs. Forex desks need to rebalance exposures, particularly in trade finance portfolios.

3. Crude Oil & Energy Imports

Expected Impact: Brent could spike 10–15% in the short term. India’s energy basket cost surges.

Banking Lens: PSU and private banks with refinery exposures (via LC/guarantees) should conduct price-stress simulations.

4. Defense Sector Surge

Expected Impact: CapEx tilts toward domestic defense. HAL, BEL, DRDO-linked MSMEs in spotlight.

Banking Lens: Consider revised lending parameters for defense-linked MSME credit, DLTFC-based lending evaluation.

5. Trade & Supply Chain Disruption

Expected Impact: Indo-Pak trade halt; impact on overland transit, especially through Punjab and Rajasthan.

Banking Lens: Inventory finance, invoice discounting in agro, textiles, and chemicals at risk. Reassess client BCPs.

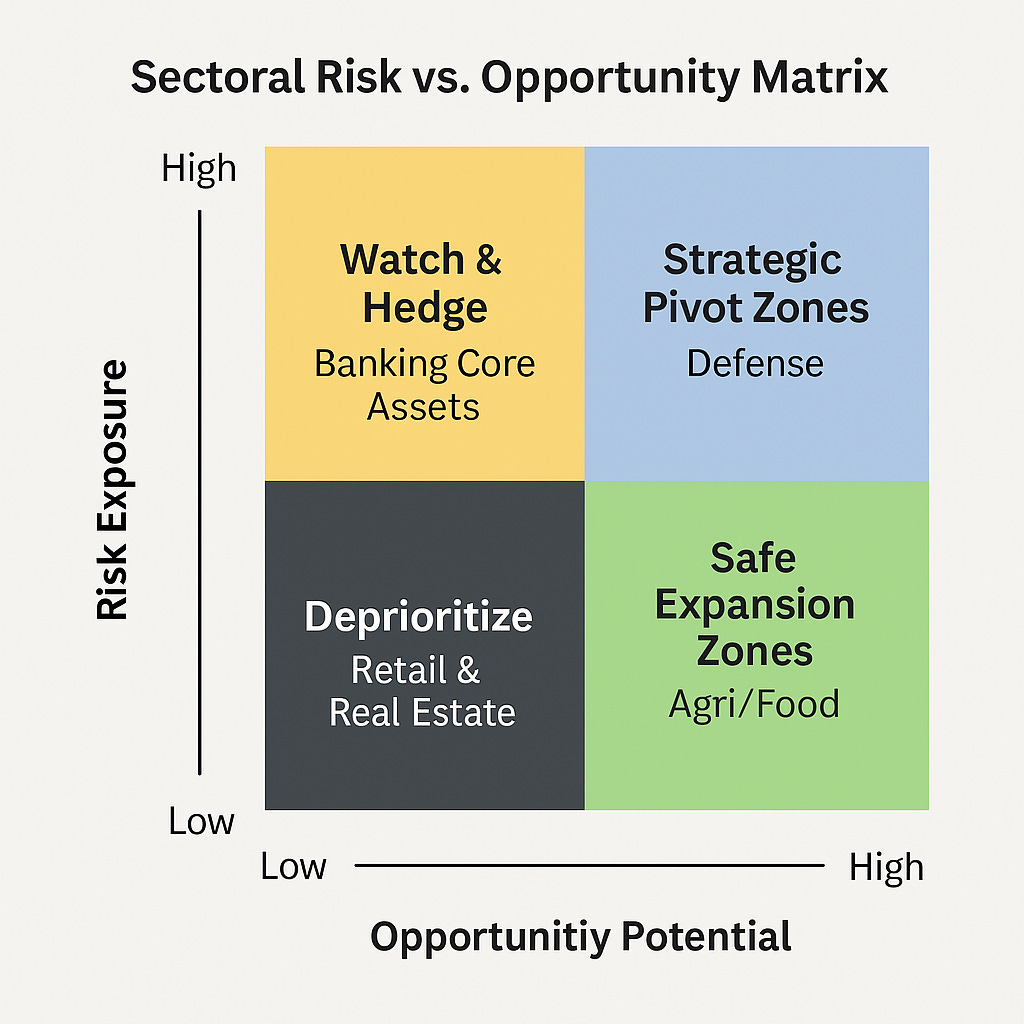

🔍 Sectoral Breakdown: Risk vs. Opportunity Matrix

A matrix to assess credit risk and growth pivot sectors.

Strategic Response Playbook: Banking Edition

Central Institutions:

RBI: Activate INR stabilization toolkit. Consider SDF (Standing Deposit Facility) adjustments.

SEBI: Market circuit protocols, foreign portfolio investor (FPI) engagement, rumor control.

Finance Ministry: Prioritize CapEx redirection to defense and infra-heavy sectors.

For Commercial Banks & NBFCs:

BCP Activation: Especially for branch networks in border states (Punjab, J&K, Rajasthan).

Liquidity Positioning: Reprioritize disbursal plans, delay non-essential lending programs.

Investor Relations: Equip treasury and leadership with conflict-sensitive briefing materials.

🌍 Global Coordination Snapshot

IMF/World Bank: May extend emergency liquidity lines to EMs with high import dependency.

Global Banks: Retrenchment from Indian CDS, EM bond holdings.

OPEC: Strategic reserve releases and output negotiations.

UN/China/US: Diplomacy ramps up as deterrence narratives emerge.

“Structured intelligence is your highest alpha in volatile markets. In conflict, clarity is capital.”

🇮🇳 Editorial Note by Intent Curiosity Sphere (ICS)

As a proudly Indian publication, Intent Curiosity Sphere (ICS) stands unequivocally in support of India’s national integrity and security stance. The inhumane Pahalgam terror attack was a direct assault not only on civilians but on the foundational values of peace and sovereignty.

ICS upholds a zero-tolerance position on terrorism and strongly denounces any state-sponsored acts of violence that destabilize our region. Our analysis, including the 10-Dimensional War Impact Framework, is designed to equip Indian institutions with strategic foresight, rooted in responsible intelligence and patriotic clarity.

We urge all readers to:

Rely only on official government and military sources for real-time updates.

Refrain from spreading unverified news or inflammatory content, particularly on social media.

“In conflict, clarity and national resolve are our greatest shields.”