Navigating Payment Gateways in India: Domestic, International, and White-Label Dynamics (2025)

Types of Payment Gateways: White-Label, Co-Branded, Hosted “Understanding Customization & Control in Gateway Solutions”

Introduction

In an economy where digital payments form the nervous system of commerce, choosing the right payment gateway—with strategic understanding of domestic vs international transactions, commission structures, compliance, and technology—is no longer optional. Whether you're a merchant, a CMS consultant, or a product lead in fintech, this guide serves as a comprehensive breakdown to inform decision-making.

1. Types of Payment Gateways

A. Domestic Payment Gateways 🇮🇳

These process transactions using Indian-issued debit/credit cards, UPI, wallets, and net banking.

Example Use Case: A D2C Indian brand collecting INR payments via UPI or RuPay cards.

Key Players: Razorpay, Cashfree, PayU, CCAvenue (India-only mode), BillDesk, Paytm.

B. International Payment Gateways

These process multi-currency transactions, enable settlements in foreign currency, and comply with FEMA, RBI, and FIRC guidelines.

Example Use Case: SaaS product in India charging clients in USD or Euro.

Key Players: Stripe (limited support in India), Razorpay International, PayPal, Payoneer, Instamojo Cross-border.

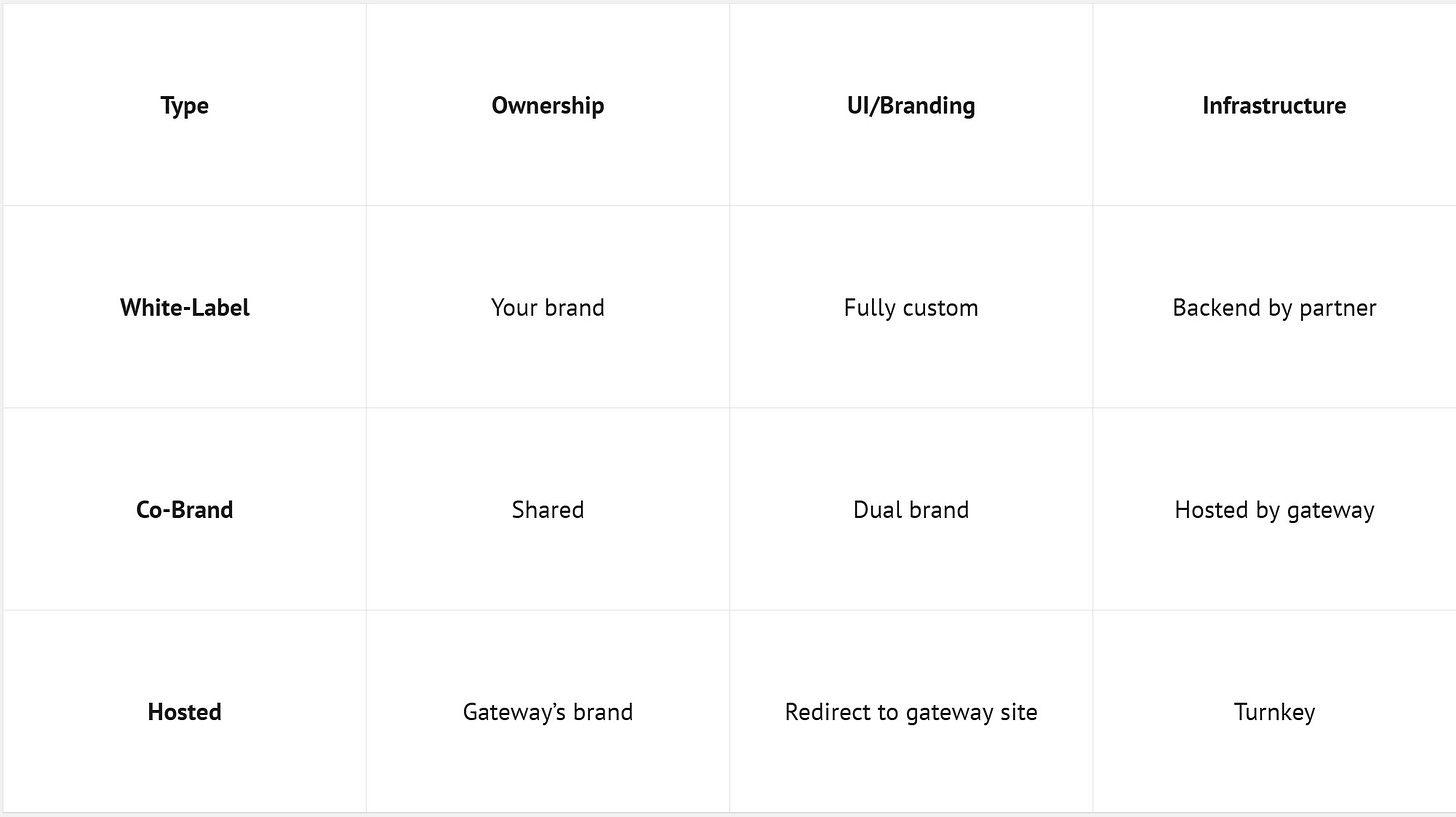

2. White-Label, Co-Brand, and Hosted Payment Gateways

White-label Examples: Cashfree, Easebuzz, NTT Data, and M2P offer full white-label solutions.

Use Cases: Fintechs, NBFCs, and banks launching their own branded payment stack.

💳 3. Chargeback, Refund & Dispute Handling

Chargeback: Triggered when a customer disputes a transaction. Regulated by RBI and card networks.

Time Window: 60–120 days from transaction.

Reasons: Fraud, duplicate charge, non-delivery of service.

Resolution Window: TAT of 45 days typical.

Gateway Liability: High-risk verticals (e.g., crypto, adult, forex) see more scrutiny.

Best Practices: Integrate strong fraud detection, have signed digital agreements, and use 2FA.

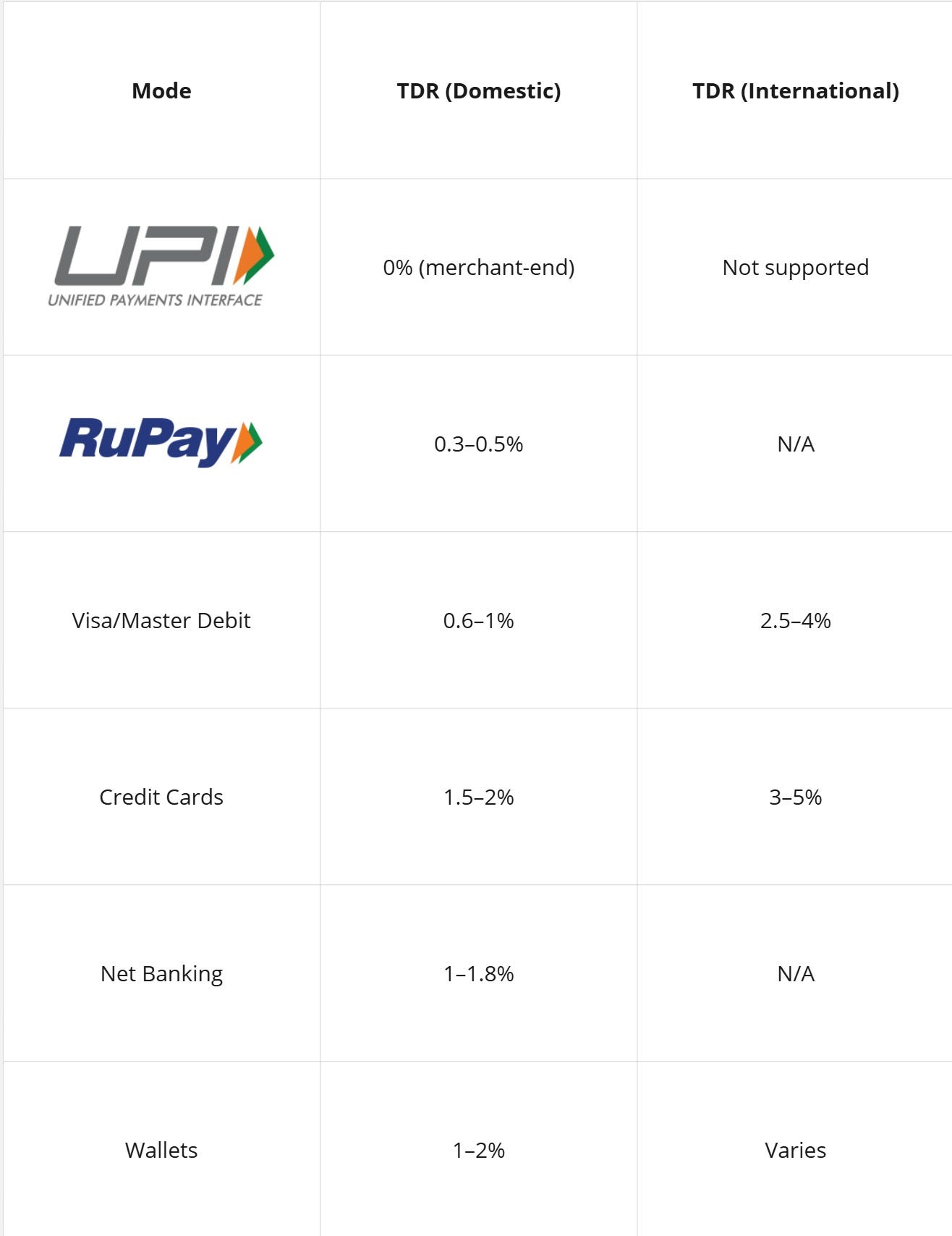

4. Payment Commission Models

Note: GST of 18% applicable on commission. White-label providers often customize rates based on volume, industry, and settlement cycle.

5. Merchant Onboarding & Client Codes

MID (Merchant ID): Unique identifier for each merchant account on a payment gateway.

TID (Terminal ID): Used for POS machines and QR-based payments.

Client Code/Partner Code: White-label or aggregator partners are issued a master code to onboard downstream merchants.

KYB (Know Your Business): PAN, GSTIN, MSME cert, bank letter, website compliance required.

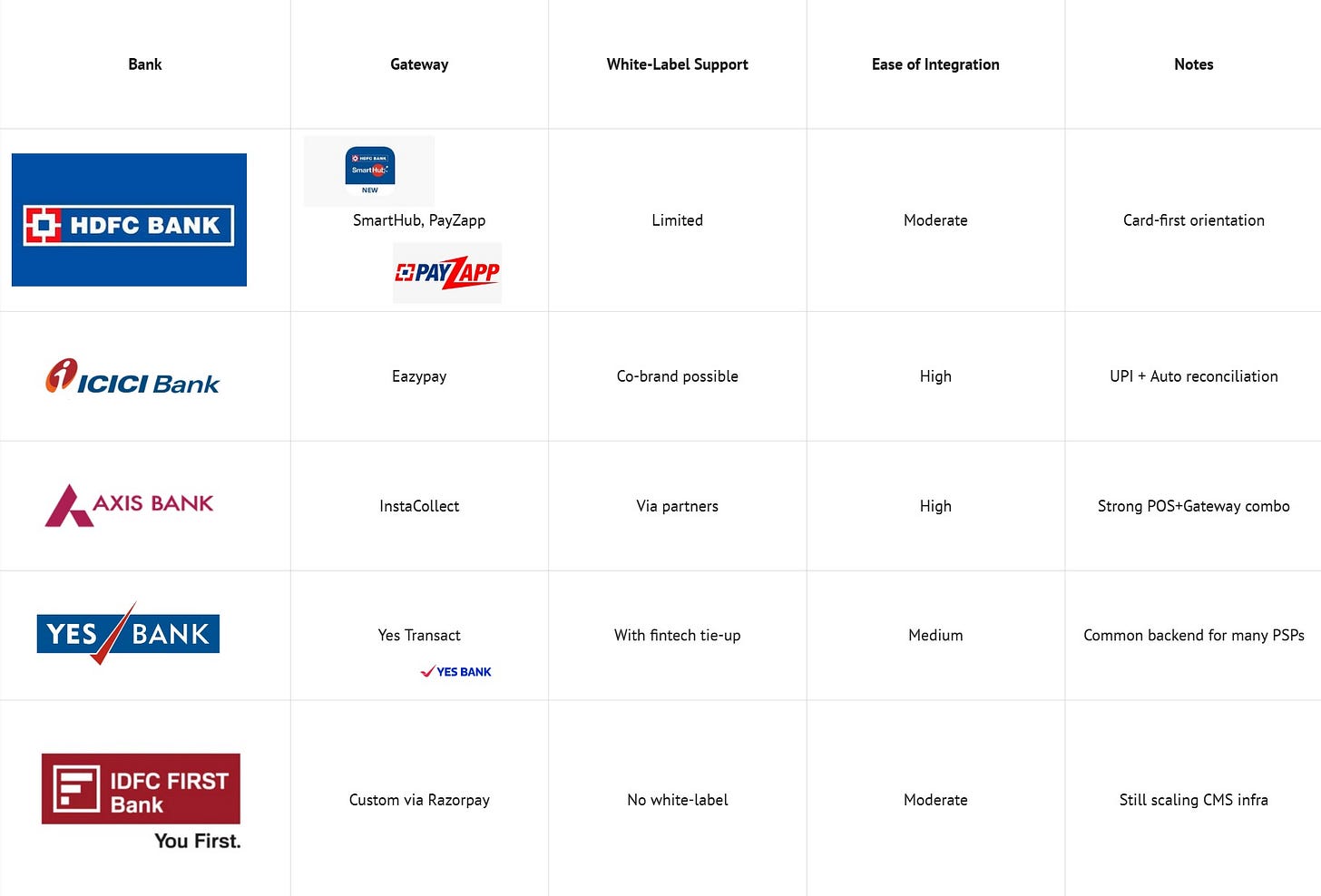

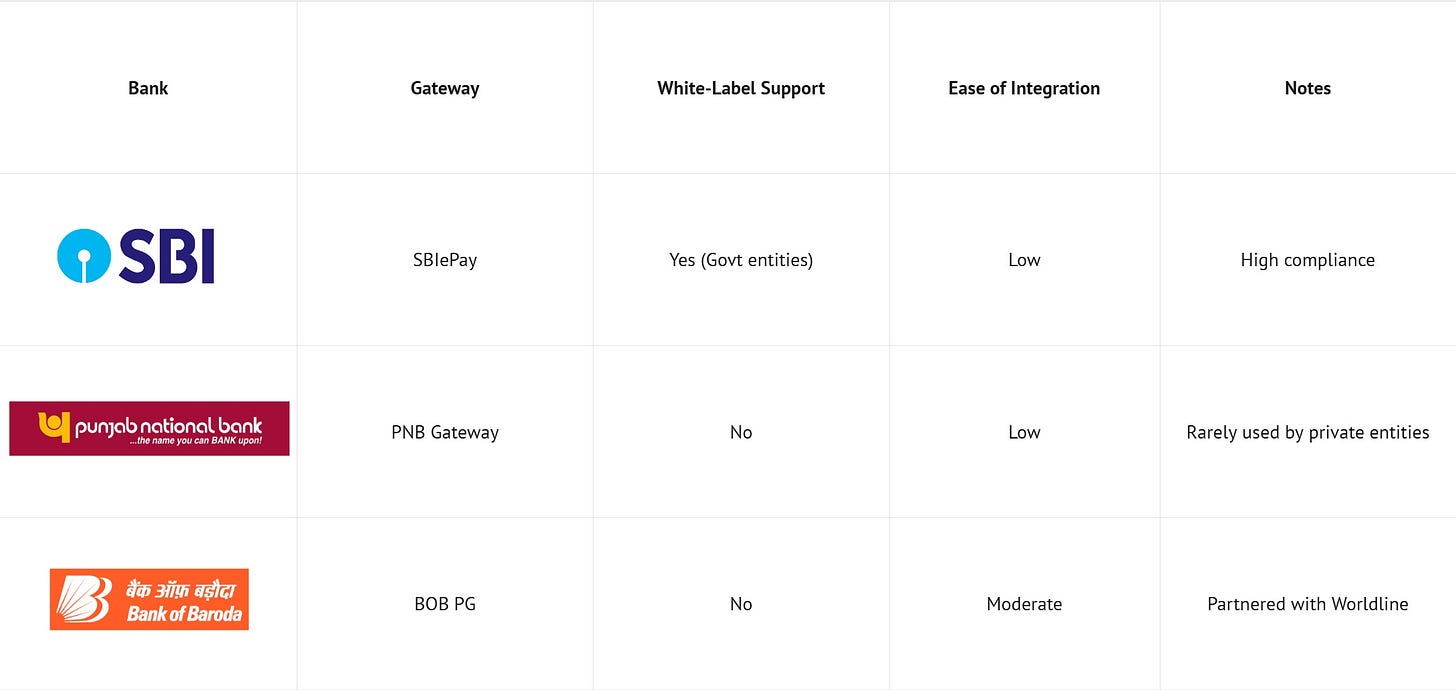

6. Technical Feasibility – Bank-Wise Gateway Support

Private Sector Banks

Public Sector Banks

7. Integration & Tech Features Checklist

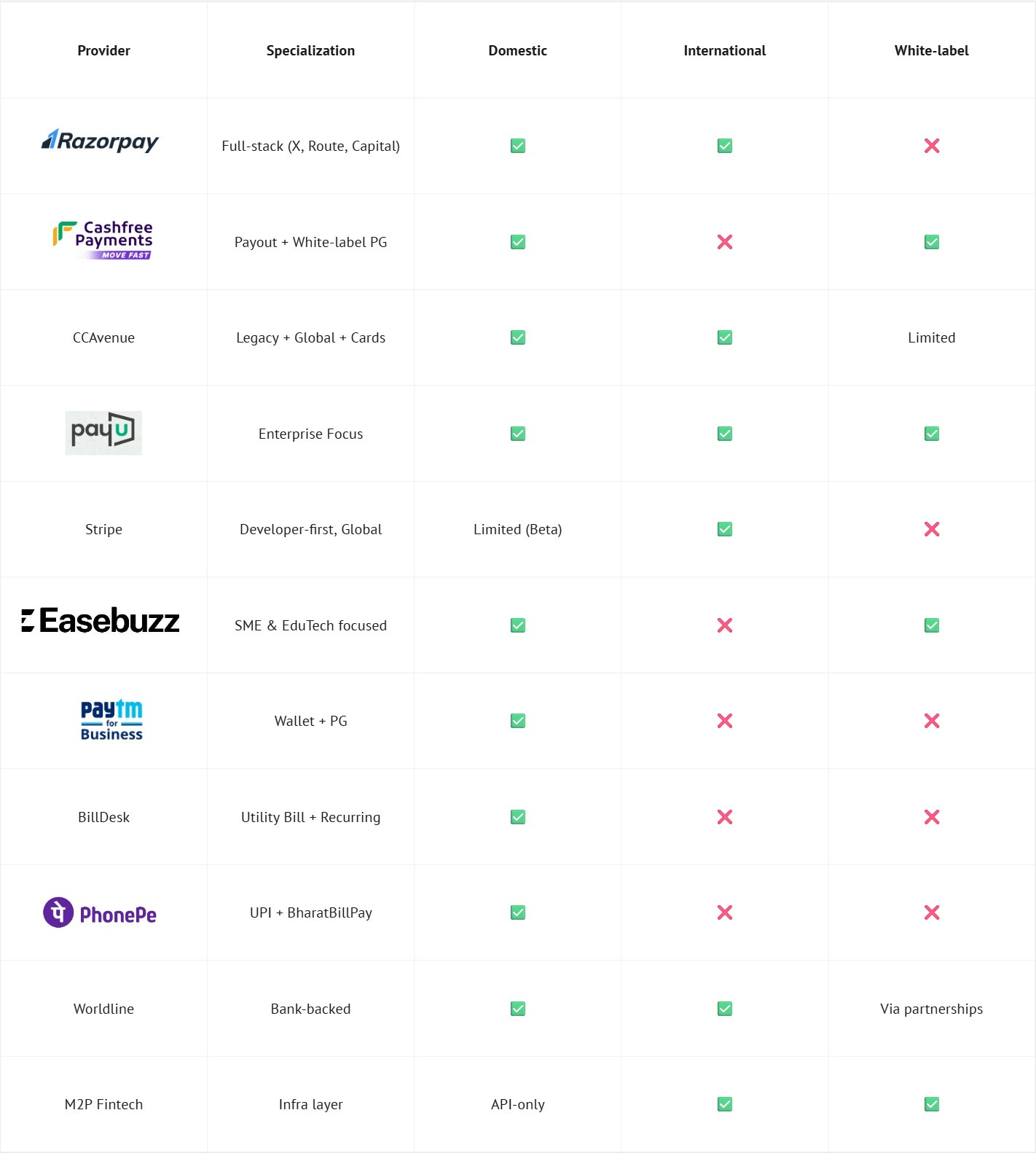

8. Major Payment Gateway Players in India (2025)

🧩 9. Strategic Recommendations

For Startups/SMEs: Use Easebuzz or Razorpay for fast onboarding and scale.

For Large Enterprises: Consider hybrid models with Cashfree for payouts and RazorpayX for banking stack.

For Cross-Border Needs: Razorpay + Stripe hybrid with FIRC automation.

For Banks or NBFCs: Explore white-label with M2P or NTT Data for custom gateways.

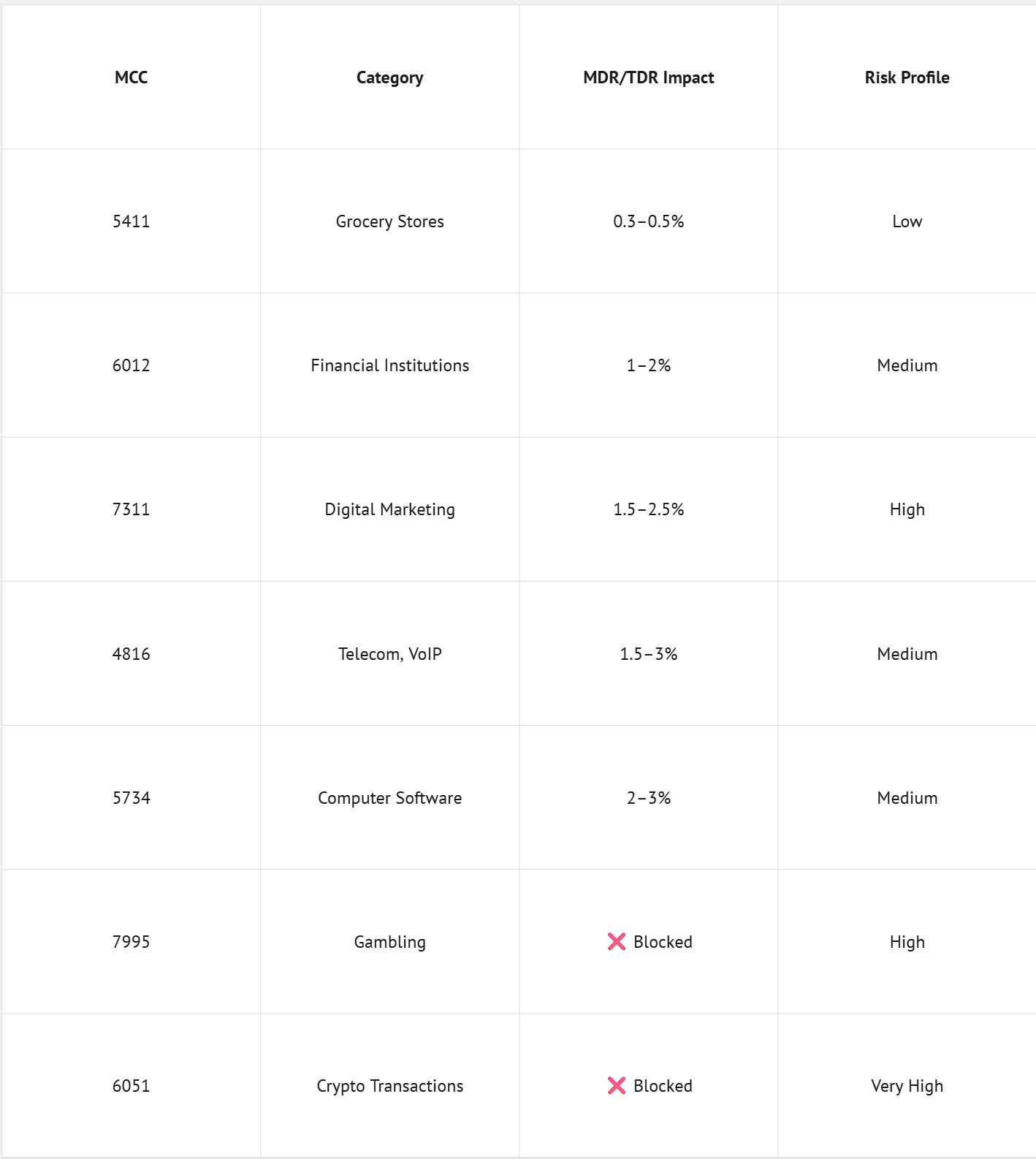

10. Merchant Category Code (MCC) – RBI Guidelines and Gateway Classification

✅ What is MCC?

MCC (Merchant Category Code) is a four-digit numeric code assigned to a business by the acquiring bank or payment processor. It categorizes merchants based on the type of products or services they provide.

📜 RBI’s Role & Guidelines

As per RBI and card network mandates (Visa, MasterCard, RuPay), the assignment of MCCs must follow these principles:

📂 Common MCC Examples (India Context)

Practical Implications for Payment Gateway Integrations

During onboarding, the PG provider assigns an MCC based on your business type and uploaded KYC/GST documentation.

Fintechs using white-label PGs must ensure their sub-merchants are MCC-compliant, especially in NBFC, EduTech, HealthTech sectors.

Chargebacks and fraud rates are monitored by MCC clusters; high-risk MCCs are subject to higher reserve or rolling payout cycles.

Incorrect MCC assignment may lead to blacklisting, settlement holds, or even regulatory penalties under RBI’s supervisory frameworks.

Integration Tip:

Always align your MCC to the exact industry you serve, not a lower-TDR workaround. RBI audits acquirers periodically for MCC integrity and AML compliance.

📌 Conclusion

Choosing a payment gateway is no longer a backend decision—it's a strategic infrastructure move. With ever-evolving compliance mandates (like tokenization, 2FA, and FEMA), and user expectations (real-time settlements, smart retries), being informed is the first step to being competitive.