“Scaling Disbursements: How India’s Banks Power Bulk Payment Infrastructure”

3rd Blog in the CMS 2025 Deep Dive Series By Amit Mankar | April 2025

🧭 Introduction

In today's digit-first financial landscape, bulk payment infrastructure has become a mission-critical pillar for businesses managing high-volume disbursements—be it salaries, vendor payouts, loan disbursals, or eCommerce refunds. Indian banks have responded with rapid innovation in their Cash Management Services (CMS) platforms, offering a wide spectrum of automation, integration, and security features.

This post provides a comparative lens into how leading Indian banks handle bulk payment operations—highlighting file upload methods, ERP/API integrations, and operational dashboards. Real-world industry use cases offer practical context for evaluation.

Bulk Payment Capabilities – Bank-wise Snapshot

Industry Examples

1️⃣ eCommerce – Axis Bank CMS

Use Case: A mid-size marketplace processes ~20,000 orders/day. Refunds & vendor commissions handled via Axis CMS.

Upload Type: Scheduled XML batch uploads

ERP Integration: Direct API for payouts + reconciliation

Webhook: Instant vendor notifications post-payout

Impact: Refund cycle reduced from 24 hours to 90 minutes

2️⃣ NBFC – ICICI Bank

Use Case: A digital NBFC disburses loans to 5,000+ customers daily

Upload Type: Secure SFTP every 3 hours

APIs Used: Mandate check, KYC validation, payout confirmation

Security: OTP-authenticated SFTP with dual control

Impact: Manual errors cut by 80%, go-live in under 6 weeks

3️⃣ FMCG – HDFC Bank

Use Case: Biweekly distributor commissions and quarterly incentive payouts

ERP Integration: SAP pushes .csv batches to CMS

Automation: Auto-generated MIS sent to sales & treasury

Impact: Incentives tied to real-time sales targets, reducing delay-led escalations

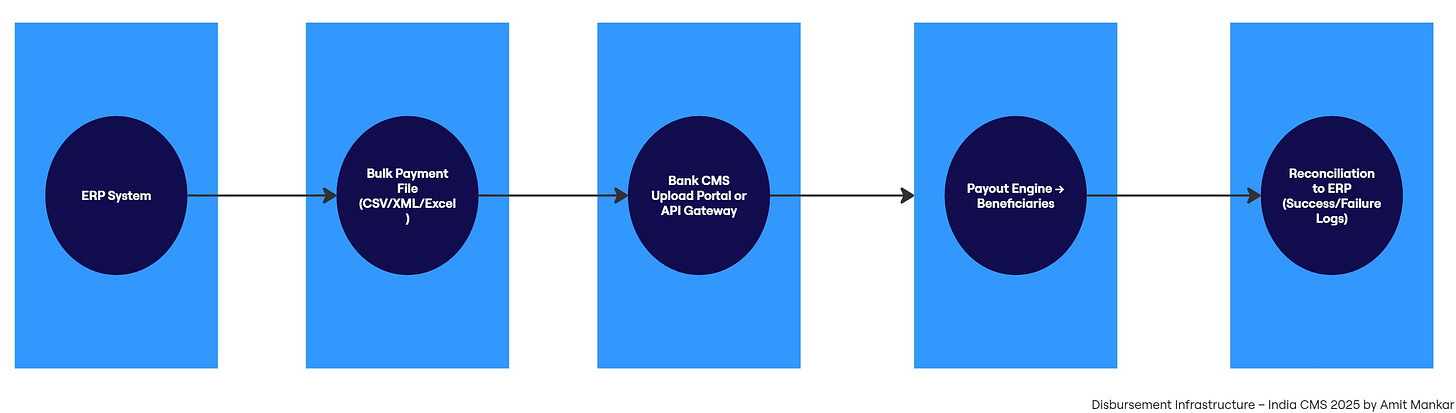

Framework: How Bulk Payments Work in a Corporate Stack

Dashboard Mockup – Bulk Upload Tracking

This UI enables real-time visibility and error traceability, critical for finance and operations teams managing bulk flows.

Adoption Scoring – Bulk Upload Tech Maturity

Scoring Basis: File format flexibility, ERP onboarding ease, depth of API suite, error traceability, UI/UX, and reconciliation tools.

💡 Final Takeaway

Selecting the right CMS partner for bulk payouts goes far beyond pricing. The focus must be on:

Tech maturity (API-first vs. file-only)

Integration speed (ERP-friendly formats, plug-in libraries)

Operational visibility (dashboards, MIS, webhooks)

Sector alignment (NBFC vs FMCG vs eCom)

✅ Private banks dominate in automation, integration depth, and turnaround time

🔒 Public banks retain PSU trust but need acceleration on CMS tech stacks

🚀 API-first CMS is no longer a value-add—it’s a baseline requirement

📌 What’s Next?

Coming Soon → “APIs in CMS – Powering Real-Time Treasury Operations”

We’ll unpack how real-time treasury APIs are transforming the CFO stack across verticals—stay tuned.