India’s Unified Payments Interface (UPI) has completely transformed the way we pay. From splitting a dinner bill to paying school fees or booking a flight, UPI has made transactions seamless. Now, there’s even more good news—the National Payments Corporation of India (NPCI) has officially enhanced UPI transaction limits across key categories starting 15th September 2025.

This move is set to make high-value payments faster, easier, and more convenient. Let’s break down what has changed, what remains the same, and why this matters to you.

What Has Changed?

Earlier, most UPI payments were capped at ₹1,00,000 per day, which meant bigger transactions needed alternatives like NEFT or RTGS. But with the new rules, UPI now supports much higher limits for certain categories such as insurance, investments, travel, and government services.

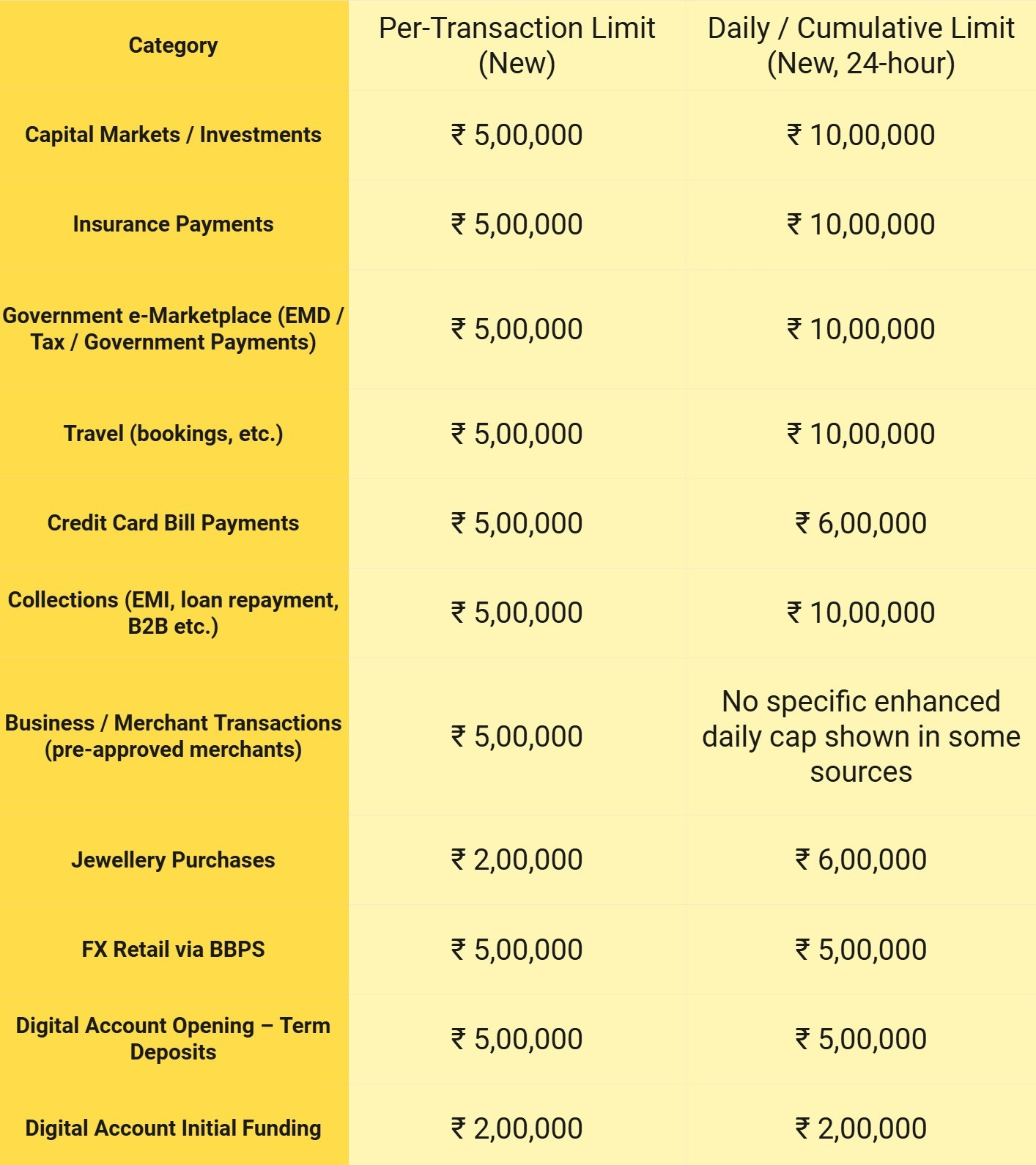

Here’s a snapshot of the new limits:

What Stays the Same?

Person-to-Person transfers (P2P) like sending money to a friend remain capped at ₹1,00,000 per day.

Limits for hospitals and educational institutions are unchanged since they already had higher ceilings.

Banks can still set their own internal limits depending on risk policies, so not all apps may immediately reflect the enhanced ceilings.

Why This Matters

One-Shot High-Value Payments

No more splitting big transactions into multiple transfers. You can now pay insurance premiums, large travel bookings, or investment amounts in one go.Business Convenience

Merchants and institutions can collect larger sums easily via UPI without depending on older banking modes.Fewer Failures, Better Flow

Higher limits reduce transaction breakdowns for genuine high-value payments.Boost to Digital India Vision

By pushing large-ticket transactions onto UPI, India takes another step towards a cash-lite economy.

Points to Keep in Mind

Bank discretion applies: While NPCI has raised limits, your bank or UPI app might enforce lower ones. Always check before making a large payment.

Fraud risk is higher: Double-check UPI IDs and merchant details before approving high-value transfers.

Merchant verification: Enhanced limits apply only for verified merchants under approved categories.

Final Word

The enhanced UPI limits are a game-changer for both individuals and businesses. From paying a ₹7 lakh insurance premium to booking a ₹4 lakh international trip, UPI is now more powerful than ever. However, it’s important to transact carefully, use trusted apps, and stay alert while making high-value payments.

UPI started as a tool for small, everyday payments. With these new rules, it has officially stepped into the big leagues of digital banking.