Virtual Account Management in 2025: Inside the CMS Engines of India's Top Banks

Comparing VAM Deployments, MIS Latency, and Sector-Specific Readiness in India’s Evolving CMS Landscape.

Source: Feature analysis based on data from

In 2025, Corporate CMS (Cash Management Services) has become the nerve center for dynamic treasury operations across industries—from NBFCs running instant credit lines to FMCG giants reconciling thousands of distributor payments daily.

At the heart of this transformation lies Virtual Account Management (VAM)—a strategic capability that streamlines reconciliation, enables real-time MIS, and powers intelligent cash flow visibility.

In Continuation

In our previous article, Decoding CMS in 2025: Feature-by-Feature Breakdown of India's Leading Banks, we outlined how Indian banks are reinventing their CMS stack across critical modules like API Banking, MIS Intelligence, ERP integration, and VAM.

This edition zooms into VAM—the reconciliation layer that separates legacy CMS from intelligent banking infrastructure.

VAM Adoption Rates: Who’s Leading the Curve?

Adoption rates tell a powerful story. While private-sector leaders like ICICI and HDFC are nearing full CMS integration, PSU banks like SBI lag in deployment—impacted by legacy core banking and slower middleware upgrades.

Union Bank stands out with 100% adoption post-digital consolidation—though deployment breadth ≠ functional depth.

VAM Architectures: A Comparative View

Private players are investing in highly modular, real-time CMS stacks. In contrast, PSU offerings are often monolithic, making change management expensive and slower.

Decoding the VAM Layer Across Industries

🔹 NBFC & Lending

ICICI’s sub-ledger mapping supports instant EMI allocation.

Kotak’s API-first VAM enables real-time co-lending reconciliation.

Challenge: PSU banks still require manual ledger sync, causing T+1 lags.

🔹 eCommerce & D2C

Axis Bank excels in omnichannel reconciliation with instant tagging.

HDFC’s custom VAM handles complex merchant ecosystems.

Gap: Mobile UI limitations and MIS delays reduce operational speed.

🔹 FMCG & Supply Chain

ICICI and Kotak offer automated tagging for distributor tiers.

SBI, though stable, lacks APIs for plug-and-play integrations.

🔹 PSU Services & Utilities

SBI and Union Bank lead in government-aligned CMS workflows.

However, these are not optimized for high-frequency commercial use cases.

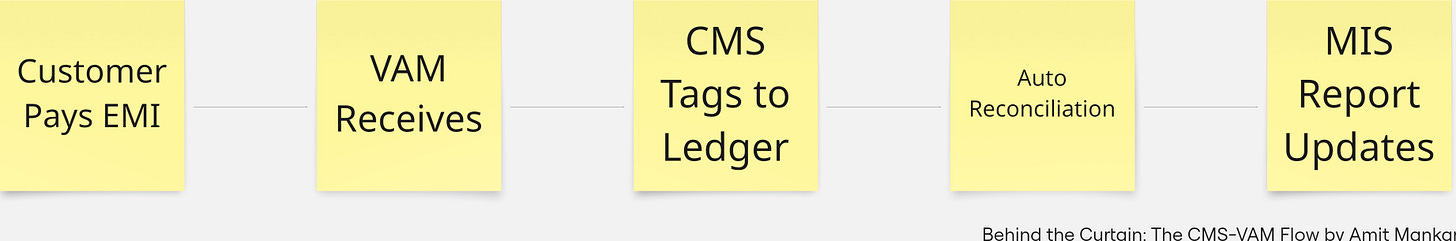

The CMS Flow Behind the Curtain

This flow varies sharply across banks:

ICICI & HDFC = Real-time loop

SBI & Union Bank = Batch-based sync (T+1/T+2)

A bank’s VAM architecture directly impacts cash visibility and working capital cycles for clients.

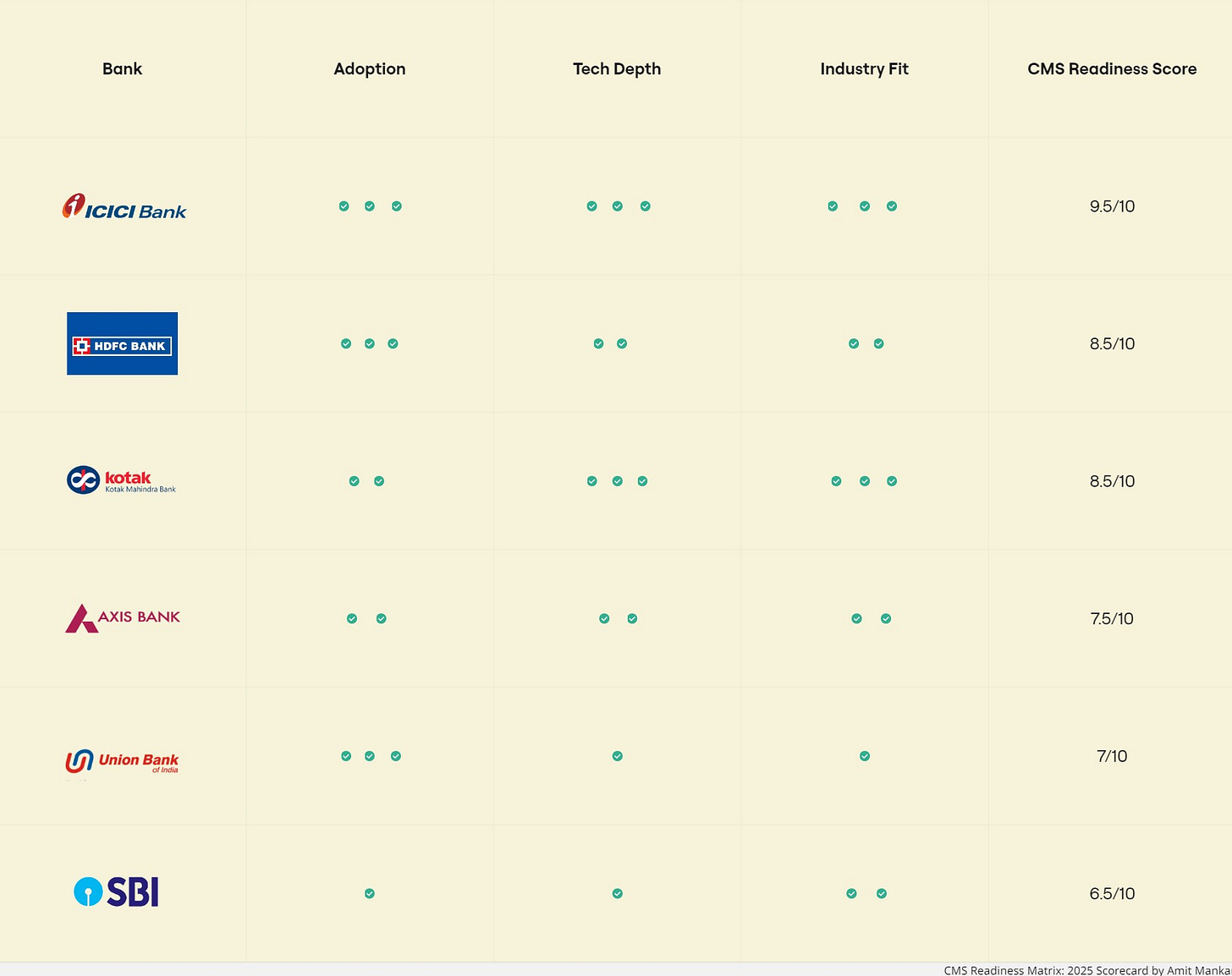

CMS Readiness Matrix: 2025 Scorecard

This matrix offers a strategic lens for CFOs, Treasury Heads, and Product Teams assessing CMS partnerships.

Closing Thoughts

Virtual Account Management is no longer a feature—it is the foundation of smart CMS.

In a world demanding instant visibility, automated reconciliation, and API-led modularity, the winners will be banks that offer:

Sector-ready plug-ins

Real-time sync & MIS

Full VAM + CMS interoperability

What’s Next in This Blog Series?

We’ll next decode:

API Banking Capabilities

Smart MIS and Insights Layer

CMS x ERP Integration Models

Modular CMS Stack Design Principles

Stay tuned as we continue to build an informed roadmap for India's next-gen CMS transformation.