n today’s transaction-heavy business environments, managing inflows securely and reconciling them efficiently is no longer a back-office function — it’s a strategic lever for cash flow optimization, compliance, and customer experience.

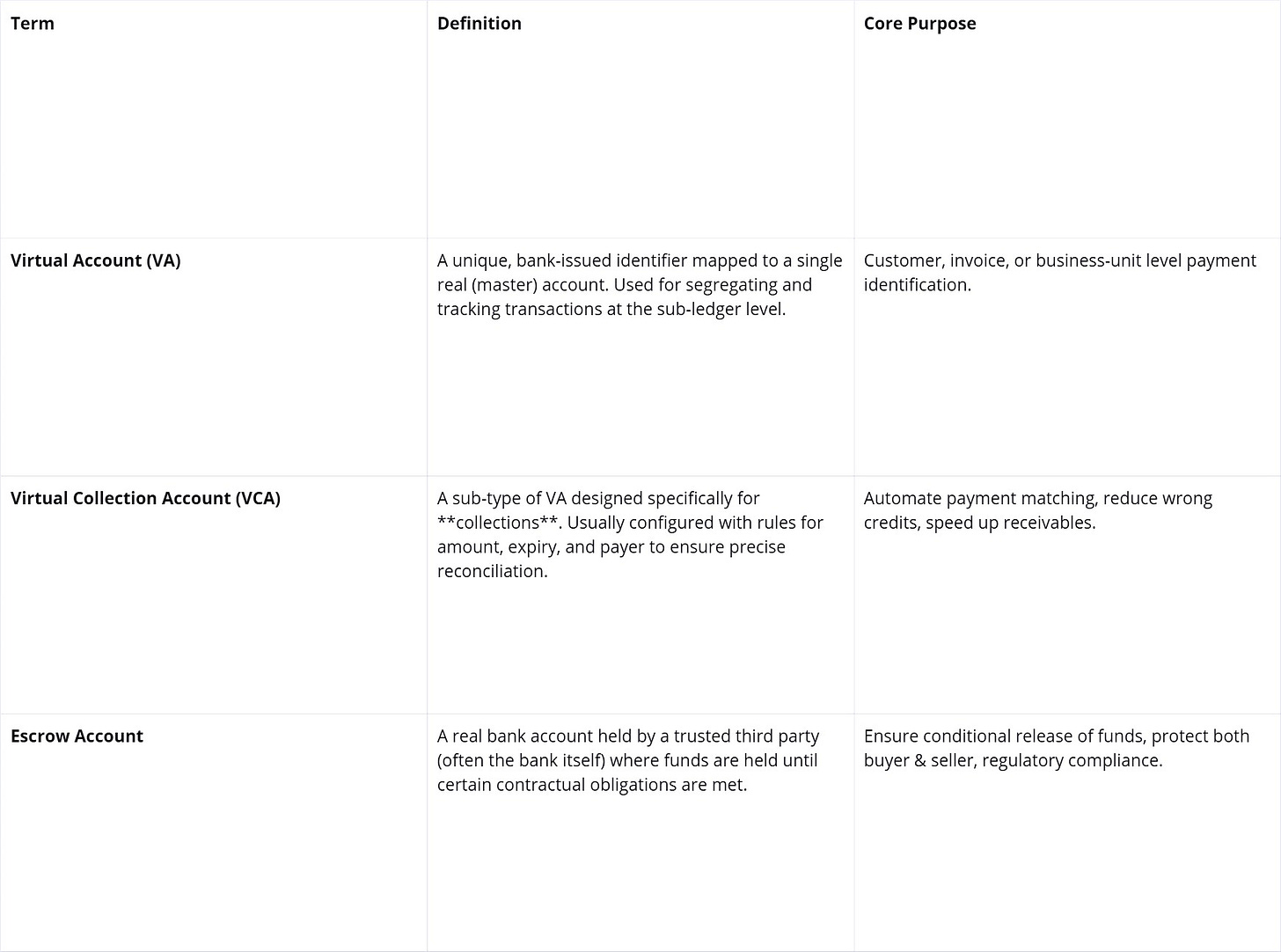

Three instruments often surface in banking & treasury conversations:

Virtual Accounts (VAs), Virtual Collection Accounts (VCAs), and Escrow Accounts.

They sound similar — but serve different operational and compliance purposes.

Here’s the complete breakdown.

2. How They Work — In Simple Terms

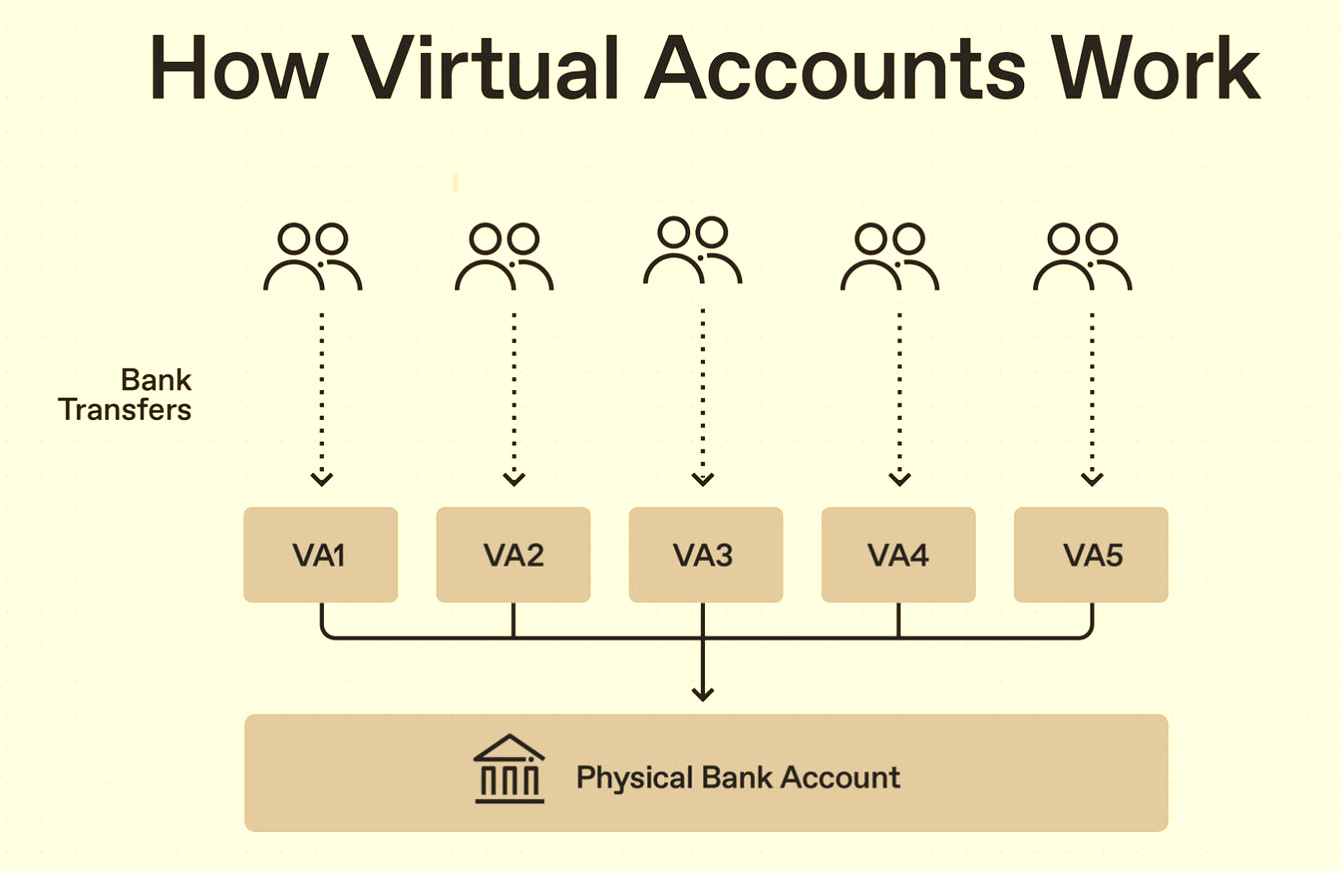

Virtual Account

Bank generates unique account numbers (VAs) mapped to a master account.

Payments made to a VA are automatically tagged with payer identity.

Can be used for both collections and payments.

Example: Distributor A → VA# 1001, Distributor B → VA# 1002. Both deposit into same master account but are tagged separately.

Virtual Collection Account

Bank generates VAs only for incoming funds.

Often has extra features: amount lock, expiry, one-time use, remitter whitelisting.

Best suited for AR automation and customer payment tracking.

Example: EMI collection for Borrower 123 is via VCA# 1001, valid for ₹15,000 only, expiry on due date.

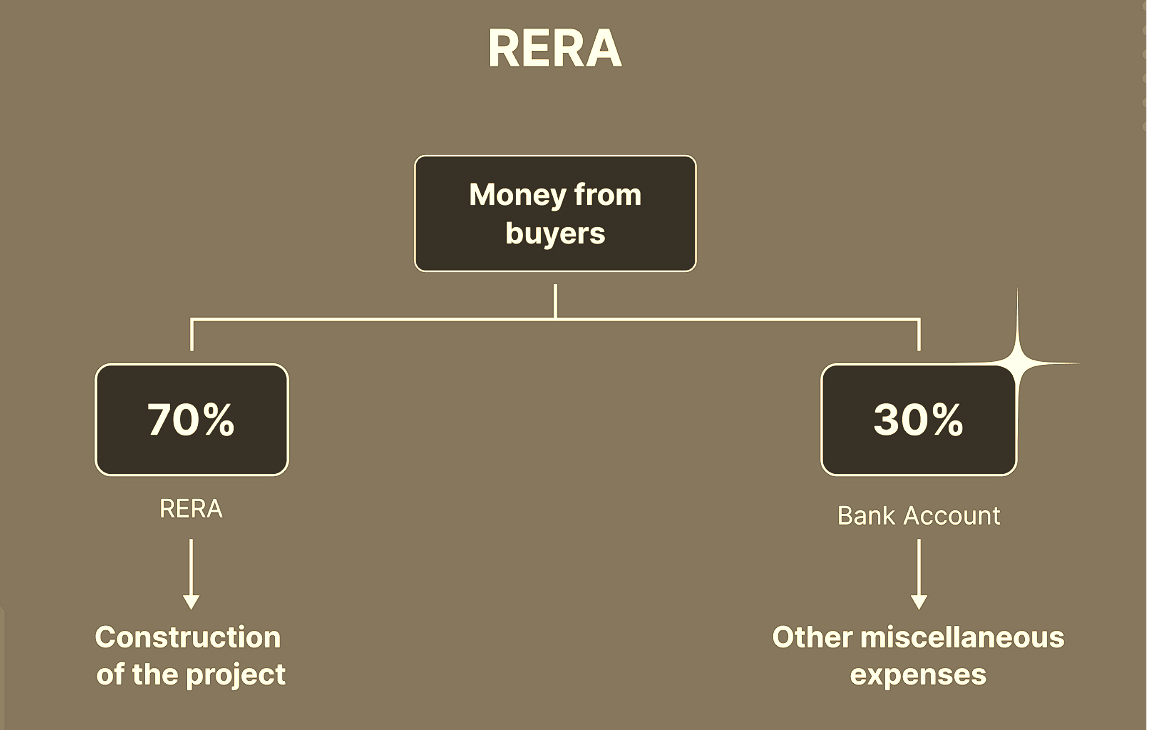

Escrow Account

Physical account with real balances.

Bank acts as a neutral third party.

Funds are released only when pre-agreed conditions are met (milestones, approvals).

Example: Property buyer deposits into escrow → bank releases to builder only after RERA compliance and construction stage verification.

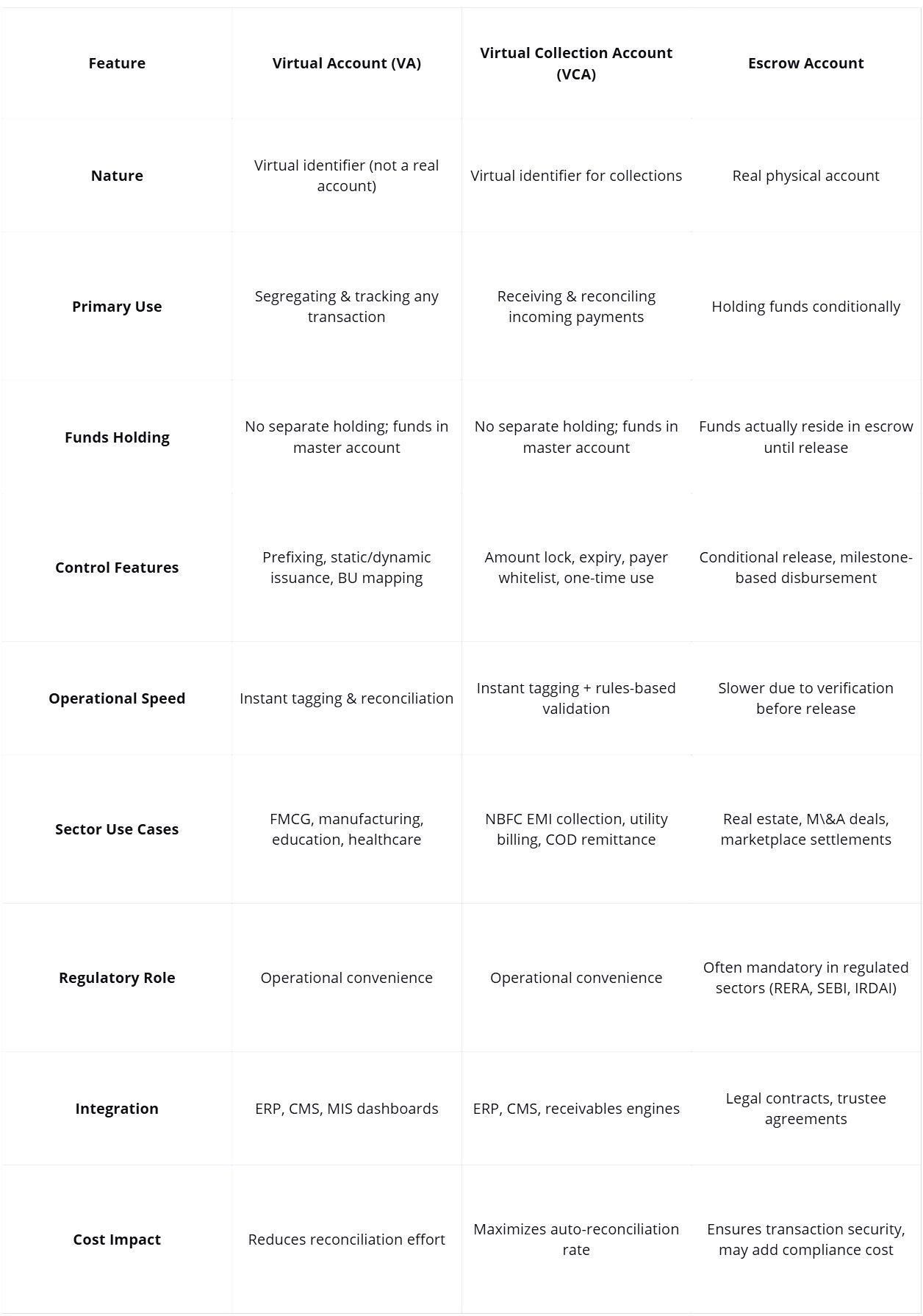

3. Detailed Comparison Table

4. Sector-Specific Scenarios

NBFC:

VA: Static for each borrower for all payments.

VCA: Dynamic per EMI for auto-matching.

Escrow: For co-lending pools to ensure fair fund release.

E-commerce:

VA: Static for each seller to track fees and commissions.

VCA: Dynamic for COD settlement per hub or courier.

Escrow: For holding customer funds until delivery confirmation.

Real Estate:

VA: Per project for internal tracking.

VCA: Per buyer for booking amount and milestone payment.

Escrow: RERA-mandated account for project fund release.

5. How to Choose the Right Option

Choose VA if:

You need a flexible sub-ledger tool for internal tracking across collections & payments.Choose VCA if:

Your biggest pain point is payment reconciliation speed & accuracy.Choose Escrow if:

You must hold funds securely until conditions are met or compliance demands it.

6. Why This Matters for Cash Management in 2025

In an API-first banking ecosystem, these tools aren’t mutually exclusive — leading corporates use all three in combination:

VAs for internal transaction segregation.

VCAs for receivables automation.

Escrow for regulatory trust & conditional settlements.

The winners will be businesses that integrate these tools directly into ERP and customer portals, turning banking into a seamless extension of their operations.